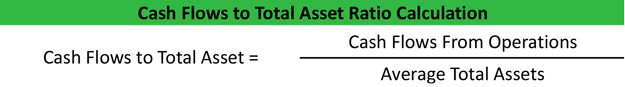

cash flow on total assets formula

Therefore the corporation has 586 percent of its assets in the form of cash reserves. Cash Flow Forecast Beginning Cash Projected Inflows - Projected Outflows Ending Cash.

What Is Cash Flow On Total Assets Ratio Definition Meaning Example

You will find it in the first section of the balance sheet.

. So to calculate it divide the operating cash flow by the average value of assets in a company for a particular year. Cash Flow 30000 - 5000 - 5000 50000 70000 Free Cash Flow Formula While a cash flow statement shows the cash inflow and outflow of a business free cash flow is a companys disposable income or cash at hand. The resulting number would be your cash return on assets ratio.

So cash flow from assets is. The formula is as follows. Average Total Assets Beginning Total Assets Ending Total Assets 2.

Operating Cash Flow Net income Depreciation and amortization Stock-based compensation Other operating expenses and income Deferred income taxes Increase in inventory Increase in accounts receivable Increase in accounts payable Increase in accrued expense Increase in unearned revenue. This results in the following cash flow from assets calculation. This gives you the companys cash flow on.

Cash flow on total assets is an efficiency ratio that rates actually cash flows to the company assets without being affected by income recognition or income measurements. The full formula of Operating Cash Flow is as follows- OCF Net Income Depreciation Stock-Based Compensation Deferred Tax Deferred Tax Deferred Tax is the effect that occurs in a firm as a result of timing differences between the date when taxes are actually paid to tax authorities by the company and the date when such tax is accrued. The formula to compute cash flow on total assets takes cash flow from operations divided by.

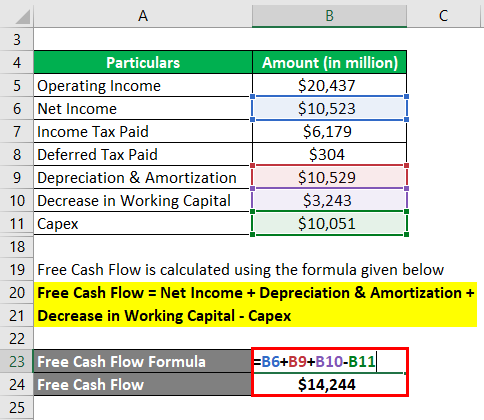

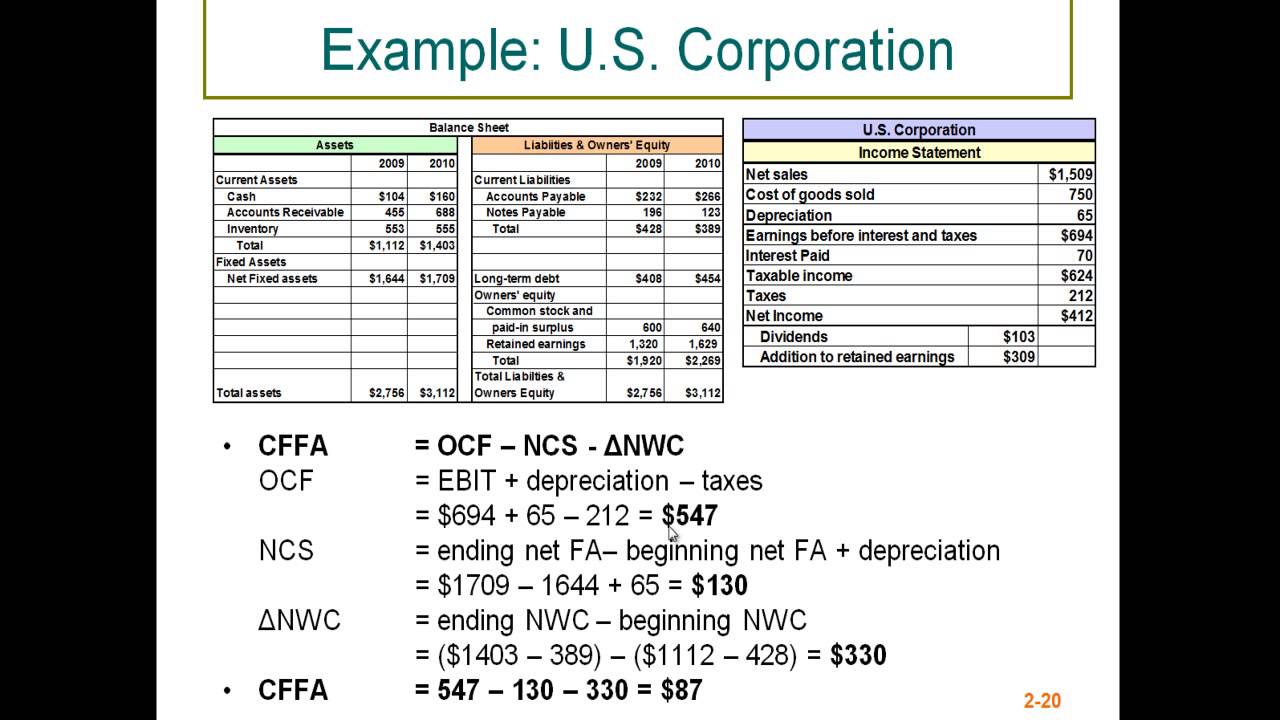

Free Cash Flow Net income DepreciationAmortization Change in Working Capital Capital Expenditure. Companies have different cash requirements. Cash flow from assets Cash flow to creditors Cash flow to stockholders Cash flow from assets 11700 2900 Cash flow from assets 14600.

Therefore the formula for calculating a companys free cash flow is. Depreciation and Amortization DA The value of various assets declines over time when used in a business. 12000 Cash flow generated by operations 10000 earnings 2000 depreciation -25000 Change in working capital 15000 payables - 30000 receivables - 10000 inventory -10000 Fixed assets -10000 fixed asset purchases -23000 Cash flow from assets.

The cash asset ratio is a financial ratio that seeks to determine a companys liquidity by assessing its ability to pay off its short-term obligations with cash and cash equivalents. 24000 -10000 2000 16000. It is calculated by taking total revenues and subtracting from them the COGS and total expenses which includes SGA Depreciation and Amortization interest etc.

Divide the cash flow figure from Step 2 by the total assets figure from Step 3. Operating Cash Flow Operating Income Depreciation Taxes Change in Working Capital. Example 15 Assume that a corporation had net cash provided by operating activities of 200000 and had capital expenditures of 140000.

The companys cash flow from assets may indicate to buyers that purchasing the company is a good value. 27000461000 x 100 586. This ratio indicates the cash a company can generate in relation to its size.

This ratio indicates the cash a company can generate in relation to its size. The formula would be. This is a positive cash flow.

Cash ROA Operational Cash Flow Total Average Assets What is a good cash return on assets ratio. This gives you the companys cash flow on total assets ratio. Add the three amounts to determine the cash flow from assets.

Its common-size percent for cash equals. Is the average of total assets between two accounting periods. Free cash flow net cash provided by operating activities capital expenditures.

3 Cash Flow Formulas. The cash flow on total assets ratio is calculated by dividing cash flows from operations by the average total assets. FCFE FCFE FCFE Free Cash Flow to Equity determines the remaining cash with the companys investors.

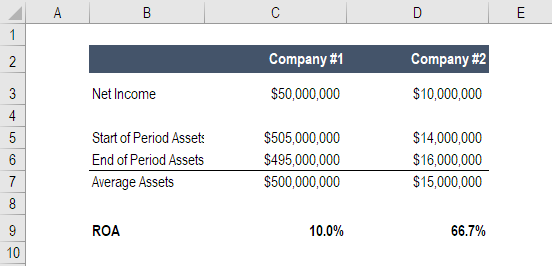

Example The cash flow to total asset. The corporations free cash flow is calculated as follows. Cash ROA Return on assets is calculated by dividing net income by average total assets.

It is the leftover money after accounting for your capital expenditure and other operating expenses. The detailed operating cash flow formula is. Cash returns on assets cash flow from operations Total assets 500000 100000 Cash Returns on Asset Ratio 5 This means that the automaker generates a cash flow of 5 on every 1 of assets that it has.

24000 -10000 2000 16000 Johnson Paper Companys cash flow from assets for the previous year is 16000. Net income Total average assets Cash return on assets The answer tells financial analysts how. Multiply the result from Step 4 by 100 to express the cash flow on total assets ratio as a percentage.

Cash Flow Forecast Beginning Cash Projected Inflows Projected Outflows Ending Cash. Cash Flow to Assets Cash from Operations Total Assets. For example a corporation reported cash of 27000 total assets of 461000 and total equity of 157895 on its balance sheet.

Cash Return on Total Assets Ratio Operating Cash Flow Average Total Assets You can calculate the average total assets by summing the beginning and ending total assets and then dividing the result by 2 as follows. Free Cash Flow Net Income Depreciation Amortization - Change In The Work Capital - Capital Expenditure. Is the net cash flow from operating activities in the statement of cash flow.

Cash Flow on Total Assets Ratio Formula Cash flow from operations. Know that cash flow from assets is equal to cash flow to creditors plus cash flow to stockholders. Cash flow from operations Total average assets Cash return on assets In the calculation the cash flow from operations figure comes from the statement of cash flows.

The denominator includes all assets stated on the balance sheet not just fixed assets. Comparing it with other automakers in the economy an investor can identify how are the growth prospects of the firm. Operating Cash Flow Operating Income Depreciation - Taxes Change In Working Capital.

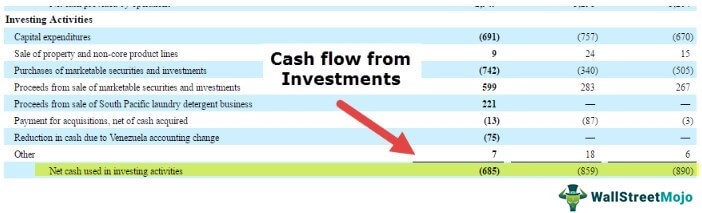

Cash Flow From Investing Activities Formula Calculations

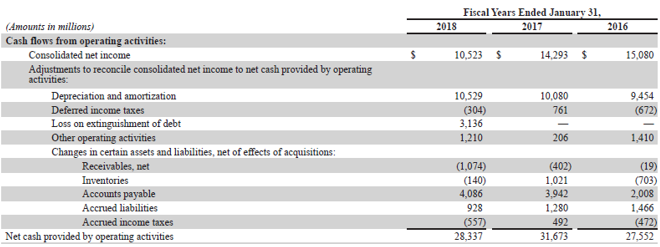

Cash Flow Formula How To Calculate Cash Flow With Examples

Cash Flow Formula How To Calculate Cash Flow With Examples

Cash Flow What Is It And What Is It For Efficy

Cash Flow Per Share Formula Example How To Calculate

Calculating The Cash Ratio Abstract

Cash Flow Formula How To Calculate Cash Flow With Examples

Operating Cash Flow Formula Calculation With Examples

Fcf Formula Formula For Free Cash Flow Examples And Guide

Net Cash Flow Formula Calculator Examples With Excel Template

Free Cash Flow Formula Calculator Excel Template

Cash Flow Formula How To Calculate Cash Flow With Examples

Cash Flow Statement Definition Example And Complete Guide Fourweekmba

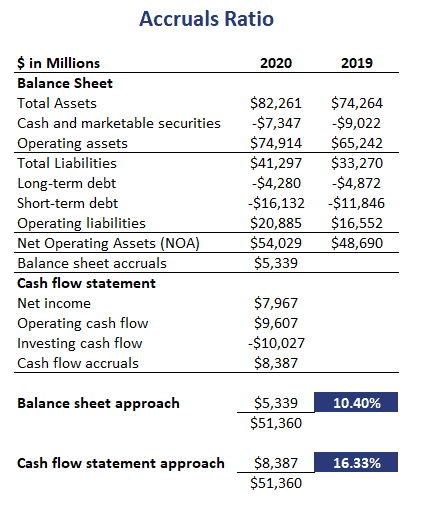

Accruals Ratio Excel Implementation

Return On Assets Roa Formula Calculation And Examples

Total Assets Formula How To Calculate Total Assets With Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

0 Response to "cash flow on total assets formula"

Post a Comment